Chairman Statement

In 2023, the Group navigated a particularly challenging landscape marked by sustained economic headwinds, global inflationary pressures, and escalating geopolitical tensions across its key market. Faced with an environment of high financing cost and capitalisation rates in The Netherlands, Germany and Australia, as well as the weak property market in the PRC, the Group has nevertheless continued to operate profitably although this is the lowest profit level since its IPO in 2014. While the net profit of S$12.5 million for FY2023 was a decrease of 90.5% from FY2022, I am thankful for the hard work and tireless efforts put in by management and all employees to navigate the Group through these difficult times.

Despite the current unfavourable market conditions, the Board remains confident in the Group’s long-term prospects, and has recommended a final tax-exempt (one-tier) cash dividend of 3.10 Singapore cents per share. If approved, the total dividend declared for FY2023 will be 4.20 Singapore cents per share, representing a 10.5% growth from FY2022. The Board remains committed to work towards a stable dividend payout with a steady growth when appropriate, subject to the successful implementation of the Group’s business strategy and prevailing market conditions.

Reflecting the general state of the PRC property market, the Group observed weaker buying sentiments for its PRC property development projects during FY2023. Whilst this has adversely affected the Group’s ability to capitalise on its expanded footprint in the Greater Bay Area (“GBA”), it has not diminished the Group’s commitment to maximise shareholder value. As such, despite slow pre-sales, the Group will continue to adopt a longer-term view as appropriate and continue to sell these development projects with an operating profit margin.

As part of the property holding segment which was a key contributing segment to the Group’s performance in FY2023, the Group’s European property portfolio remained strong and recorded a total operating income of €46.7 million in FY2023, a 9.5% increase as compared to FY2022. The increase was due mainly to the continued recovery of the European hospitality sector which was underpinned by strong post-Covid-19 travel demand. The Group has been actively managing its European property portfolio, and with the completed renovations of the Bilderberg Europa Hotel Scheveningen and the Bilderberg Hotel De Keizerskroon during FY2023, the ongoing Dreeftoren Amsterdam office and residential redevelopments which would complete in FY2025 and FY2026 respectively, as well as the commencement of the Puccini Hotel Milan, Tapestry Collection by Hilton and Prins Hendrikkade Amsterdam redevelopments in FY2024 due for completion in FY2025, the Group’s recurring income from this segment will be further enhanced.

In light of the weakened PRC economy, the Group has continued to take a prudent and cautious approach with its PRC property financing business. As a result, the property financing revenue shrank 18.9% from S$64.6 million in FY2022 after taking into account certain pro forma adjustments, to S$52.4 million in FY2023, due mainly to a lower average PRC loan book. The PRC property financing loan book stood at approximately RMB1.2 billion as at 31 December 2023 and is expected to further decline in FY2024.

Group Performance

Arising from the challenging year in FY2023, the Group achieved an annual net profit of S$12.5 million, a decrease of 90.5% from FY2022. The decrease in net profit was the result of lower gross profit contribution from the Group’s property development and property financing business segments, and a significantly lower foreign exchange gain net of fair value loss on financial derivatives.

As at 31 December 2023, the Group’s equity attributable to owners of the Company, consolidated gross borrowings and consolidated net gearing ratio based on book value amounted to approximately S$1,973.1 million, S$1,258.2 million and 0.52 respectively.

The Group continues to adopt a foreign exchange risk management strategy that takes into account the changing business and economic outlook of the various regions that the Group operates in. The Group has sufficiently hedged its € and A$ asset base, whereas it will continue to monitor and hedge its RMB foreign exchange exposure, considering the associated costs of RMB/CNH-denominated borrowings and/or financial derivatives, and take appropriate actions when necessary. During the course of FY2023, the Group further increased its hedge against its RMB asset exposure which remains a key business risk to the Group. As at 31 December 2023, the Group has hedged approximately 80.9% of its RMB-denominated net assets, which is a marked increase from prior years. With respect to all its foreign currency exposure, there is no assurance as to the effectiveness and success of such foreign currency risk exposure management actions that the Group might or might not take. There could be a material adverse financial impact on the Group should the S$ weaken significantly against the €, A$ and/or RMB.

As at 31 December 2023, the Group recorded a cumulative translation loss of S$113.3 million as part of reserves in its shareholders’ equity (2022: S$64.1 million), arising mainly from the Group’s exposure to RMB which depreciated against S$ in FY2023.

Property Development

In the PRC, despite the slow pre-sales for the Group’s development projects which are mainly in Dongguan, owing to the overall weak property market sentiment, the Group has adopted a longer-term view and will focus on maintaining a good operating profit margin instead of turnover speed. A substantial number of the Group’s PRC property development projects will be ready to commence handover for at least a part of their respective developments during the course of FY2024.

In The Netherlands, the Group is progressing with the Dreeftoren Amsterdam redevelopment, albeit with a six-month delay due to the bankruptcy of the project’s façade contractor. As such, the targeted completion dates have been revised to 2Q2025 for the office tower and 2Q2026 for the residential tower. Upon completion, the project will comprise mainly of a refurbished and enlarged 20-storey office tower with 20,231 square metres (“sqm”) of gross floor area (“GFA”) and a new 130-metre residential tower with 312 apartment units. As for the freehold Meerparc and Prins Hendrikkade in Amsterdam, the Group is currently in ongoing discussions with the municipality on their respective redevelopments.

In Australia, the construction of the 39.9%-owned City Tattersalls Club (“CTC”) project in Sydney is on schedule. The main contractor works are approximately 13% completed as at 31 December 2023 based on the claimed contract works. The completion of the CTC project, which includes 241 residential apartment units and a 110-room hotel, is expected in FY2027. The Group will continue to monitor the residential market conditions in the Sydney central business district (“CBD”) and construction progress before determining the appropriate time for the residential pre-sale launch. The Group has increased its equity stake in the hotel component from 70.5% to 90.5%, thereby further enhancing its property holding portfolio.

Skyline Garden, Dongguan, PRC

In December 2023, the 27%-owned Skyline Garden project in Dongguan handed over its last residential apartment block comprising 364 units, which is almost fully sold.

Time Zone, Dongguan, PRC

In December 2023, the 17.3%-owned Humen Time Zone commenced its first handover of two residential apartment blocks (452 units) which were 95.6% sold on average. As Phase 1.1 and Phase 1.2 are at an advanced stage of construction, the various residential and SOHO loft blocks from these two phases are expected to be progressively handed over to the buyers during the course of FY2024 and FY2025.

Discussions are ongoing with the Dongguan local government regarding the potential rezoning of a substantial portion of the originally approved commercial GFA, encompassing three office towers (198,100 sqm) and four SOHO blocks (308,900 sqm, including a 40,000 sqm hotel), into residential GFA.

Central Mansion, Dongguan, PRC

A total of four residential apartment blocks comprising 386 units of the 36%-owned Central Mansion in Humen, Dongguan, have been launched for pre-sales, with the latest block launched in January 2024. The project has achieved a sales rate of 21% at an average selling price of approximately RMB35,800 per square metre (“psm”). The project is expected to commence the first handover of two residential apartment blocks in late 2024 or early 2025.

Fenggang Project, Dongguan, PRC

The completion of the resettlement exercise for the Fenggang project was finalised in June 2023. The next milestone would be the approval for the rezoning exercise which is expected to be obtained in 1H2024, following which the land conversion premium is to be paid in instalments.

Based on the finalised land conversion premium and related costs, the Group’s land cost in the project is estimated to be approximately RMB13,400 psm per plot ratio. As the project company is currently negotiating for a lower monetary compensation to the village community, this could lead to a reduction in the estimated land cost.

Primus Bay, Guangzhou, PRC

The 95%-owned Panyu Primus Bay has launched six residential apartment blocks comprising 539 units for pre-sales and achieved a sales rate of 18% at an average selling price of approximately RMB23,400 psm. The project commenced its first handover of the sold residential units for three of the six blocks in January 2024 instead of the initially planned December 2023. All sold units from the remaining three blocks are expected to be handed over in 1H2024.

While the project has been selling at an operating profit, a write-down of S$24.6 million was made in FY2023 on grounds of prudence.

Exquisite Bay, Dongguan, PRC

The 46.6%-owned Exquisite Bay has launched three residential apartment blocks comprising 271 units for pre-sales and achieved a sales rate of 29% at an average selling price of approximately RMB25,300 psm. The project is expected to commence the first handover of the sold residential units from June 2024.

Egret Bay, Dongguan, PRC

The 27%-owned Egret Bay has launched six residential apartment blocks comprising 311 units for pre-sales, including one block recently launched in December 2023. It has achieved a sales rate of 48% with an average selling price of approximately RMB42,100 psm. The project is expected to commence its first handover of the sold residential units in 1H2025.

The Brilliance, Dongguan, PRC

The wholly-owned The Brilliance has launched three residential apartment blocks comprising 323 units for pre-sales, including one block newly launched in December 2023. It has achieved a sales rate of 13% with an average selling price of approximately RMB21,400 psm. The project is expected to commence its first handover of the sold residential units in late 2024.

Kingsman Residence, Dongguan, PRC

The 50%-owned Kingsman Residence has launched three residential apartment blocks comprising 308 units for pre-sales in mid-September 2023. It has achieved a sales rate of 17% with an average selling price of approximately RMB19,800 psm. The project is expected to commence its first handover of the sold residential units in late 2024.

Millennium Waterfront Project, Chengdu, PRC

The wholly owned Millennium Waterfront Plot E1 launched 288 units for pre-sales, out of a total of 2,228 units in two SOHO blocks. 111 SOHO units were sold at an average selling price of RMB7,200 psm. The sold units are expected to be handed over in mid-2024.

Regarding the Plot E1 retail podium, approximately 44% has been leased and negotiations with potential tenants are ongoing.

Dreeftoren Redevelopment, Amsterdam Southeast, The Netherlands

Due to the bankruptcy of the façade contractor in late September 2023, the Dreeftoren redevelopment project is expected to be delayed by six months. The targeted completion dates have been revised to 2Q2025 for the office tower and 2Q2026 for the residential tower respectively. The façade contractor has since been taken over by a new investor and the Group has engaged the successor company for the remaining façade works.

Upon completion of construction, the project will comprise mainly a refurbished and enlarged 20-storey office tower with 20,231 sqm of GFA and a new 130-metre residential tower comprising 312 units.

Prins Hendrikkade 16-19, Amsterdam, The Netherlands

Following the acquisition of the Prins Hendrikkade property in December 2023, the Group is in discussion with the municipality on the full renovation of the property which entails a predominantly office property with five residential units.

The Group submitted the building permit application on 31 January 2024 after finalising the renovation plan with the municipality. Redevelopment is expected to commence in 2Q2024, with estimated completion in FY2025.

Redevelopment of Meerparc, Amsterdam, The Netherlands

The Group is in ongoing discussions with the municipality to redevelop the freehold Meerparc, from a 19,143 sqm (GFA) office cum industrial property, into a 50,000 sqm (GFA) mixed residential (60%) and office (40%) property.

Discussions are ongoing regarding the Group’s proposal for a residential composition of 55% mid-rent and 45% free sector (based on the number of units) for the project. Subject to the outcome of this discussion, the Group may have to reassess its redevelopment option if the eventual residential composition imposed by the municipality is financially unviable.

CTC Project, Sydney, Australia

Construction on the Group’s CTC project commenced in March 2023, shortly after the 39.9%-owned developer trust signed a construction agreement with Richard Crookes Construction Pty Limited as the main contractor in February 2023. The contract price comprised both fixed and variable components.

As at 31 December 2023, the main contractor’s works are approximately 13% completed based on the claimed contract works. Upon the expected completion in FY2027, the CTC project will comprise the refurbished City Tattersalls Club, 241 residential apartment units and a 110-room hotel. Regarding the 241 saleable residential units, the Group will continue to monitor the market conditions in Sydney CBD and the construction progress before determining the appropriate time for pre-sale launch. In addition, the Group has increased its equity stake in the 110-room hotel component from the initial 70.5% to 90.5%, thereby further enhancing its property holding portfolio.

The Group, together with Tai Tak as its JV partner, will be providing construction financing to the developer trust as part of its property financing business.

Property Holding

Property holding was the best performing segment for the Group in FY2023, being the only segment to grow its revenue and gross profit line by 30.5% and 29.0% over FY2022 respectively. The increase was due mainly to the full-year contribution from the FS Han Mai Mall in Shanghai which was acquired by the Group via a foreclosure auction in April 2022 as part of the Group’s enforcement action on a defaulted loan, and the continued recovery of the European hospitality sector which was underpinned by strong post-Covid-19 travel demand.

Looking at the Group’s commercial office property portfolio, the 33%-owned FSMC NL Property Group B.V. has been working on asset enhancement initiatives to upgrade and modernise the entrance areas of the Mondriaan Tower which has a GFA of 24,880 sqm, so as to enhance the leasing potential of the property. These renovation works were completed in December 2023 and the toilets on most of the floors will be undergoing upgrading as the next phase of asset enhancement program. Tenants who have already signed new leases commencing in FY2024 will increase the occupancy of the office building to 86%. In addition, discussions on several potential new leases and lease extensions are currently underway.

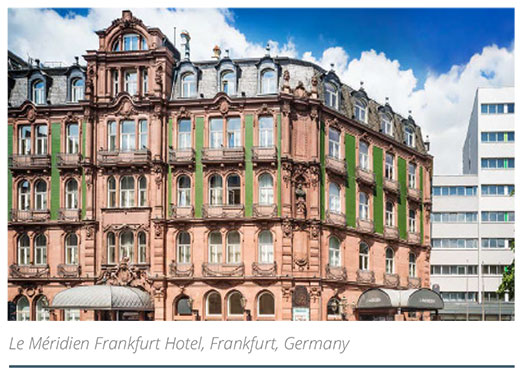

On the hospitality front, with the completion of the renovation for the Bilderberg Europa Hotel Scheveningen and Bilderberg Hotel De Keizerskroon during FY2023, the two hotels are expected to contribute positively with full-year operating income from FY2024 onwards. The Group is working to develop the wholly-owned bare-shell Puccini Milan hotel into a 4-star 59-room Puccini Hotel Milan, Tapestry Collection by Hilton, while the Group’s 50%-owned Le Méridien Frankfurt will also undergo major renovations involving the complete refurbishment of all 80 rooms in the Palais wing and the addition of 29 new rooms to the current 300-room inventory. Both projects are expected to be completed in FY2025 and will contribute positively to the recurring income of the property holding segment.

In the PRC, the post-Covid-19 recovery also positively impacted the Group’s wholly-owned Chengdu Wenjiang hotels. The hotels achieved improved earnings before interest, tax, depreciation and amortisation (“EBITDA”) of RMB21.2 million for FY2023, setting a record EBITDA for the two hotels since the commencement of operations in 2016 and achieving significant improvement of close to 80% compared to FY2022’s EBITDA of RMB11.9 million. On divestments, the Group’s 90%-owned East Sun entered into an agreement to divest its remaining 49% equity interest in the most significant property (“Dalingshan Industrial Property”) in the Wan Li Portfolio known as the Dalingshan Industrial Property, valuing the property at RMB135 million, which represents a premium of approximately 78% over its allocated cost. The divestment was successfully completed on 29 November 2023.

The Netherlands

The 95%-owned Dutch Bilderberg hotel portfolio recorded an EBITDA of €6.0 million in FY2023. The drop from FY2022’s EBITDA of €7.8 million was due mainly to business interruption arising from the renovation of the Bilderberg Europa Hotel Scheveningen and Bilderberg Hotel De Keizerskroon as well as the absence of Covid-19 subsidies.

With the renovations of the aforementioned hotels completed during FY2023, the Group is looking forward to the recurring income contribution from these two hotels from FY2024 onwards.

The 33%-owned Hilton Rotterdam hotel recorded a slightly improved EBITDA of €3.3 million for FY2023 (FY2022: €3.1 million), and also set the record for the highest average daily rate (“ADR”) achieved since its acquisition in 2018 of €167 (FY2022: ADR of €145).

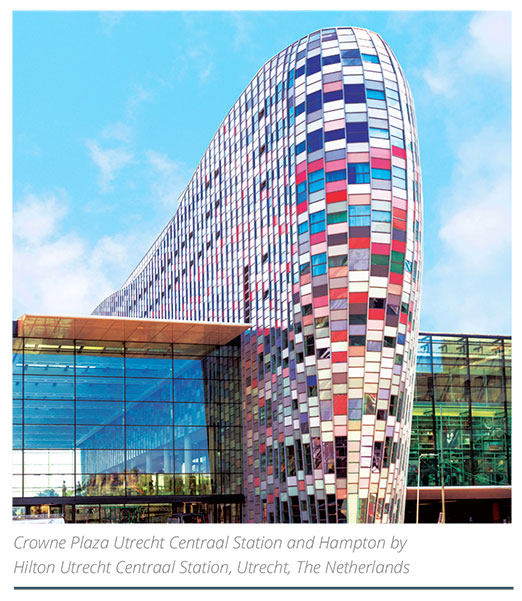

The Hampton by Hilton and Crowne Plaza in Utrecht achieved strong trading results in FY2023 with an EBITDA of €5.5 million generated by the two hotels, or approximately 41% higher than the €3.9 million recorded in FY2022. This is attributable to a higher occupancy of 86.1% in FY2023 (FY2022: 73.4%) as well as a higher ADR of €134 for the year (FY2022: €119).

Germany

The recovery of the Dresden hospitality market remained strong in FY2023. The Bilderberg Bellevue Hotel Dresden recorded an EBITDA of €4.0 million for FY2023 (FY2022: €2.7 million). The hotel recorded a higher occupancy of 67.6% in FY2023, compared to the 56.6% achieved in FY2022.

The hotel also saw the completion of its asset enhancement initiatives during 2023. These included the installation of 993 solar cells which are expected to generate over 400MWh annually, approximately 25% of the hotel’s average electrical consumption, as well as the construction of an underground parking garage (44 lots) in the East Wing basement of the hotel which was funded by the previous owners amounting to €2.5 million.

The 50%-owned Le Méridien Frankfurt hotel recorded an EBITDA of €1.6 million in FY2023 (FY2022: €2.0 million) despite an improved FY2023 occupancy of 59.2% (FY2022: 51.2%). The drop in EBITDA is due mainly to higher labour and other operating cost.

The Group is working on a major renovation of the Palais wing which involves the complete refurbishment of all 80 rooms and addition of 29 new rooms to the current 300-room inventory. Renovation works are expected to start in late 2024 and complete in 1H2025.

The PRC

Both the Crowne Plaza and Holiday Inn Express hotels in Chengdu recorded significant improvement to their performance in FY2023 as the hotels were not subject to Covid-19 restrictions and were no longer used as quarantine hotels. The hotels recorded an EBITDA of RMB21.2 million in FY2023, a 78.4% improvement over the year before (FY2022: RMB11.9 million), making this a record year for the hotels despite the slowdown and issues faced by the PRC economy.

Property Financing

Given the challenging macro environment coupled with the weak economic sentiment in the PRC, the Group’s focus for its property financing arm in 2023 was on the prudent management of its existing loan book instead of its expansion. As a result, the property financing revenue shrank 18.9% from S$64.6 million in FY2022 after taking into account certain pro forma adjustments, to S$52.4 million in FY2023, due mainly to a lower average PRC loan book.

Whilst the current PRC property financing loan book stands at approximately RMB1.2 billion as at 31 December 2023, the PRC loan book is expected to further decline in FY2024 as the Group remains cautious in disbursing new loans in view of the weak property market and certain existing loans will mature during the year.

That said, with the ongoing construction of the CTC project in Sydney, the Group is expected to disburse more loans to the various stakeholders of the project. As such, interest income from the Australian property financing segment is expected to improve over the next few years.

Corporate Social Responsibility

Against the backdrop of global economic challenges and geopolitical tensions, the Group’s commitment to Corporate Social Responsibility (“CSR”) remains resolute. Whilst the Group remains steadfast in its efforts to give back to the communities in which it serves, it is also cognizant of the ongoing events around the world which have underscored the importance of sustainable practices. For FY2023, CSR activities were undertaken by Hilton Rotterdam, the Hampton by Hilton and Crowne Plaza Utrecht Centraal Station (“Poortgebouw Utrecht hotels”), Bilderberg Bellevue Hotel Dresden, the Dutch Bilderberg hotel portfolio and the Chengdu Wenjiang hotels.

On the social activities front, amongst others, the Hilton Rotterdam team participated in the (i) Ronald McDonald Homerun, a 24-hour running and cycling marathon to raise funds for the Ronald McDonald Foundation, (ii) Stichting NAS project, which saw the team collecting soap bottles for the homeless, (iii) Salvation Army project, where team members voluntarily donated clothes and (iv) Stichting niet graag een lege maag, an initiative which saw the team prepare lunch for children of less privileged families. The Poortgebouw Utrecht hotels participated in (i) sending a team to visit the Ronald McDonald Huis Utrecht, a local charity dedicated to supporting families with sick children in their time of need by baking cakes and cookies for family members, (ii) ‘mag ik dan bij jou’, a program by the children’s hospital Wilhelmina Kinderziekenhuis (“WKZ”) which provides hotel room(s) to accommodate parents whose children are in WKZ if the Ronald McDonald House at the WKZ is full and (iii) the Cliniclowns program which collects and sells used toners from copiers and printers and sells them to raise funds which are then used to send clowns to visit and entertain children in hospitals. The Bilderberg Bellevue Hotel Dresden team hosted 34 vocation school teachers from Kazakhstan in the fields of hospitality and gastronomy to better understand the German dual school system and it also continued its Wunschweihnachtsbaum event, which is organised annually together with Kindervereinigung Dresden e.V. to grant Christmas wishes to socially disadvantaged children.

Further contributing to CSR in 2023 is the Dutch Bilderberg portfolio of hotels. The various hotels hosted many CSR activities during the year and key amongst these include (i) fund-raising for the Ronald McDonald charity via the selling of toys, (ii) support for local projects such as Christmas dinner for the homeless, lunch at school for disadvantaged children, collection of clothing/medicines for Ukraine and/or disaster-struck areas and (iii) the cooperation with the municipality of Vaals to collect goods for Ukrainian refugees and to provide laundry for Ukrainian families who do not have access to a washing machine.

In Chengdu, the Wenjiang hotels held their annual 12 May charity sale activity in remembrance of the huge earthquake that stuck Wenchuan on 12 May 2008. The funds raised will be used to help children in the area who have lost their normal learning conditions and also to support children’s education in impoverished areas. The Chengdu Wenjiang hotels also hosted a charity concert in 2023 to support the visually impaired, by bringing love and hope through music.

Matched by the Group’s commitment to its communities, is also the importance of environmentally sustainable practices. The Hilton Rotterdam team continued in its participation of (i) Clean the World initiative which involved the collection and recycling of used soap bars which were then redistributed to children and families in countries with a high death rate due to acute respiratory infection (pneumonia) and diarrhoea diseases (cholera) and (ii) the collection of plastic bottle caps which were exchanged for cash at the local supermarket and donated to the KNGF Geleidehonden charity. The Poortgebouw Utrecht hotels participated in (i) the ‘Hotels for Trees’ program in which a tree is planted each time hotel guests opt out of their daily room cleaning and (ii) the ‘Too-good-to-go’ app which allows anyone using the app to purchase clean breakfast leftovers at a discount. The Dutch Bilderberg portfolio of hotels also contributed by only using toilet paper from the ‘Good Roll’ program, whereby it is 100% tree-friendly and sustainable and the program donates 50% of its net profit to building toilets in Africa.

The Group is dedicated to supporting initiatives that promote community cohesion, social and environmental well-being, and the development of strong business-to-community partnerships.

Future Prospects

In light of the geopolitical tensions and global inflationary pressures, the Group is committed to navigate through this period of economic turbulence, maintaining the delicate balance between financial prudence and seizing good business opportunities.

As a testament to their unwavering support and commitment, the Group’s two key shareholders have exercised part of their warrant holdings in October 2023, raising S$234.6 million of new equity funds for the Company. The two key shareholders still hold additional warrants expiring on 21 March 2029 which can potentially raise an additional S$169.3 million. Coupled with the substantial unutilised committed credit facilities, the Group is well-positioned not only to manage any economic challenges arising from the difficult market conditions, but to also capitalise on any favourable business opportunities that may arise.

Appreciation

Despite the numerous challenges we have faced, First Sponsor stands strong today thanks to the unwavering support of our many stakeholders. On behalf of the Board, I extend our deepest gratitude for your dedication and commitment to the Group’s success. To my fellow Directors, thank you for your invaluable vision, wisdom, experience, and guidance. To our shareholders, customers, business associates, bankers, and partners, your steadfast support has been instrumental. Your faith in us is truly valued. Let us continue to work together, overcoming obstacles to achieve even greater success in FY2024.

On behalf of the Board and management, I would also like to extend a special thanks to my fellow Directors, Ms Ting Ping Ee Joan Maria and Mr Yee Chia Hsing, who will be stepping down at the coming 2024 AGM after a tenure of more than nine years. They have been invaluable members to the Board, contributing their expertise, wisdom, and dedication to our organization, seeing the Group’s diversification into The Netherlands, Germany and Australia since IPO. Their leadership and insights have been instrumental in bringing First Sponsor to where it is today. They will be sincerely missed, and we wish them all the best in their future endeavours.

As we bid farewell to our retiring directors, I am pleased to welcome Ms Low Beng Lan to the Board. With Ms Low’s strong background in hospitality, finance and treasury management, she will be a good complement to the Board.

Ho Han Leong Calvin

Chairman

11 March 2024